Home » Project Overview » Haib Copper

Content of this page is currently being updated and will be available soon.

Rio Tinto Zinc drilling operation at Haib in the period 1972-1975.

Koryx Copper drilling operation at Haib in 2025.

The Haib copper deposit is well exposed, with numerous secondary copper minerals such as malachite and chrysocolla evident in fractures and joints, especially along the Volstruis (Ostrich) river which traverses the centre of the deposit. German prospectors were the first known Europeans to recognise the copper mineralisation at Haib and undertook minor mining in the late 1800’s to early 1900’s.

Well-known local prospector, George Swanson had a long, but intermittent history with the project from the post Second World War period through to the early 2000’s. At various stages he undertook small scale mining operations at Haib, including leaching operations and selling hand sorted high-grade copper to the O’okiep Copper Company near the town of Springbok in South Africa some 150 km to the south.

The first significant exploration program was carried out by Falconbridge in the period 1963 to 1964. Falconbridge undertook mapping, stream sediment sampling and limited ground electromagnetic surveys and drilled 11 diamond drillholes (1,012 m).

King Resources from South Africa were active at Haib in 1968 and 1969 and carried out the first Induced Polarisation (IP) survey of the area and 21 diamond drillholes (3,485 m).

Rio Tinto Zinc (RTZ) optioned the property in late 1971 and carried out extensive work programs from 1972 to 1975 focusing on a more systematic approach to assessing the Haib deposit and also the regional potential including the Lorelei porphyry Cu occurrence some 120 km to the north west. The RTZ program included regional and detailed mapping, an extensive IP/Resistivity survey, the drilling of 120 diamond drillholes at Haib and adjacent areas (~45,900 m) and metallurgical testwork. RTZ drilling was carried out on a nominal 150 m by 150 m grid with vertical drillholes. (Photo below is from RTZ drilling; note vertical drillhole)

Through the early to mid-1990’s, companies from South Africa attempted to develop the Haib project as a “potential world class copper producer for the 1990’s” (Revere Resources SA Ltd) and carried out mostly desktop studies of its economic viability (Rand Merchant Bank of South Africa (RMB)).

In March 1995, Australian company, Great Fitzroy Mines NL (GFM), RMB and George Swanson agreed terms to form a joint venture known as the Namibian Copper Joint Venture (NCJV) which was essentially operated by GFM. The NCJV drilled 12 diamond holes (~5,445 m), 5 geotechnical drillholes and excavated an adit and two crosscuts of 126 m in length. Bulk samples from the adit were used to carry out metallurgical testwork, as well as milling and grinding studies. A Feasibility Study was produced in 1998 which was to be the basis for development of the project, but the NCJV activities were terminated in 1999 due to financial constraints amid difficult market conditions at the time.

In 2004 Deep South Mining Company (Pty) Ltd was awarded EPL 3140 covering an area of 74,563 hectares. The licence was transferred to Haib Minerals (Pty) Ltd (Haib Minerals) in 2013 and remains valid with a current size of 36,589 hectares. Haib Minerals is the Namibian subsidiary of Koryx Copper Inc. (previously known as Deep South Resources Inc. (DSR)).

Teck concluded a joint venture agreement on the licence in 2008 and acted as operator of the project while earning a 70% interest in Haib Minerals. This 70% interest in Haib Minerals was acquired by DSR in 2017 in exchange for shares in DSM and Teck remains a significant shareholder in Koryx Copper at present.

The work carried out by Teck focused primarily on assessing regional prospectivity with specific detailed work on the Haib deposit aimed at increasing grade and tonnage. Work included remote sensing studies, regional geophysical data interpretations and ground geophysical surveys (IP/Resistivity and audio magnetotellurics (AMT)), regional stream sediment and soil sampling and detailed (Anaconda Style) mapping. Teck also relogged and resampled RTZ drillholes. Teck drilled 32 diamond drillholes, 22 of which were on the Haib deposit (10,508 m) and 10 on satellite target areas (3,745 m). Teck also produced the first “modern” 3D geological model of the Haib deposit. Significantly, Teck were also the first company to drill inclined holes at Haib.

After Teck’s withdrawal from the joint venture in 2017, DSR undertook numerous studies, culminating in a Preliminary Economic Assessment (2018 and updated in 2021). The PEA focused on bio-leaching technologies and other assumptions which Koryx now believes are not suitable for the Haib deposit.

DSR commenced drilling to increase the confidence in the mineral resource estimate classification in 2021. This program was interrupted by a dispute with the Namibian Government which was resolved with the renewal of the licence in July 2023. Drilling re-commenced in late 2023 and was completed in Q2 2024.

The current management and technical team commenced involvement in September 2024 marking the change in strategy to accelerate the project towards development.

The Haib copper project is located in southern Namibia close to the border with South Africa. The southern boundary of the project is within 2 km of the Orange River which forms the international border in this area. The national highway between South Africa and the capital city of Windhoek is about 15 km to the west of the project.

The nearest town is Noordoewer, approximately 25 km to the southwest, which serves the local farming community as well as offering Immigration and Customs services for entry to and from South Africa. The nearest rail connection is at Grunau 120 km to the north along the main highway. This rail connection could give access to ports on the west coast of Namibia at Luderitz or Walvis Bay or to those in South Africa via the border crossing at Ariamsvlei about 180 km to the east.

Geology of the Haib Copper Project

The Haib porphyry copper deposit is located within the Richtersveld Subprovince within the Namaqua-Natal Metamorphic Province. Haib forms part of the Palaeoproterozoic Richtersveld Magmatic Arc made up of the Orange River Group (ORG) basaltic to rhyolitic composition volcanic rocks and Vioolsdrif Intrusive Suite (VIS) plutonic rocks, mainly granites and granodiorites. The host rocks to Haib have undergone up to four periods of deformation and have been regionally metamorphosed to greenschist facies. Prominent, magnetic NE-SW trending Neoproterozoic dolerite-gabbro dykes intrude the area around Haib.

Haib is one of two known porphyry copper deposits in the Richtersveld Magmatic Arc with another smaller, lower grade body know at Lorelei about 120km to the northwest and located within the Ai-Ais National Park (see regional geology map). At 1.9Ga (billion years old), Haib is one of the oldest porphyry copper deposits known, but despite its age and deformation history retains many of the characteristics typical of these deposits.

The Paleoproterozoic rocks in the area are overlain by younger Karoo rocks of the Karasburg Rift Basin to the west of Haib. The Karoo rocks are composed of basal tillite, limestones, siltstones and shales. Magnetic dolerite sills of Cretaceous age are prominent in the Karoo rocks.

Haib Subgroup volcanics of the ORG and VIS rocks on the eastern half, with an unconformity into the Karoo Sediments on the western half. The Haib volcanics are primarily composed of a Feldspar Porphyry (FP) andesite with minor amounts of intercalated rhyolite in the north. The VIS intrusives are a mix of granodiorite-granite composition rocks, generally forming large batholiths intruding the Haib volcanics.

Regional geology of Haib and surrounding areas (note location of Haib and Lorelei, the two currently know porphyry copper occurrences in the area).

The main rock types at Haib are Quartz Feldspar Porphyry (QFP) and a Feldspar Porphyry (FP). The QFP is interpreted as a quartz diorite body which intruded the porphyritic feldspar andesite about 1.87 Ga. The FP is generally interpreted as being part of the suite of ORG volcanic rocks although some authors have suggested that it may be partially of intrusive origin. The QFP is elongated along the orientation of the Volstruis River valley, largely coincident with the location and orientation of many of the higher grade intersections within the deposit. Most of the rocks exhibit typical porphyry copper type alteration zones associated with mineralisation. Potassic hydrothermal alteration coincides with the main mineralised area, surrounded by sericitic / phyllic and propylitic alteration. Propylitic and sericitic alteration appear to overprint the earlier potassic zones. Silicification, sericitisation, chloritisation and epidotisation are widespread.

The dominant sulphides within the Haib deposit are pyrite and chalcopyrite with (in decreasing order of abundance) minor molybdenite, bornite, and chalcocite. If any supergene enriched zone was formed as part of the original porphyry copper deposit, it has been eroded away and the deposit is considered deeply eroded. Surface oxidation has led to the formation of secondary copper minerals such as malachite, azurite, chrysocolla and minor chalcocite, generally formed within fractures and joints. The oxidation of copper sulphides rarely occurs below 30 m from surface, and then usually only within fractures. Fresh sulphides are commonly observed at or near surface. The oxide zone is volumetrically a minor part of the deposit, but copper grades are often above average, suggesting the potential for a small leachable oxide resource.

Molybdenum and gold, while relatively minor, have the potential to be important by-products.

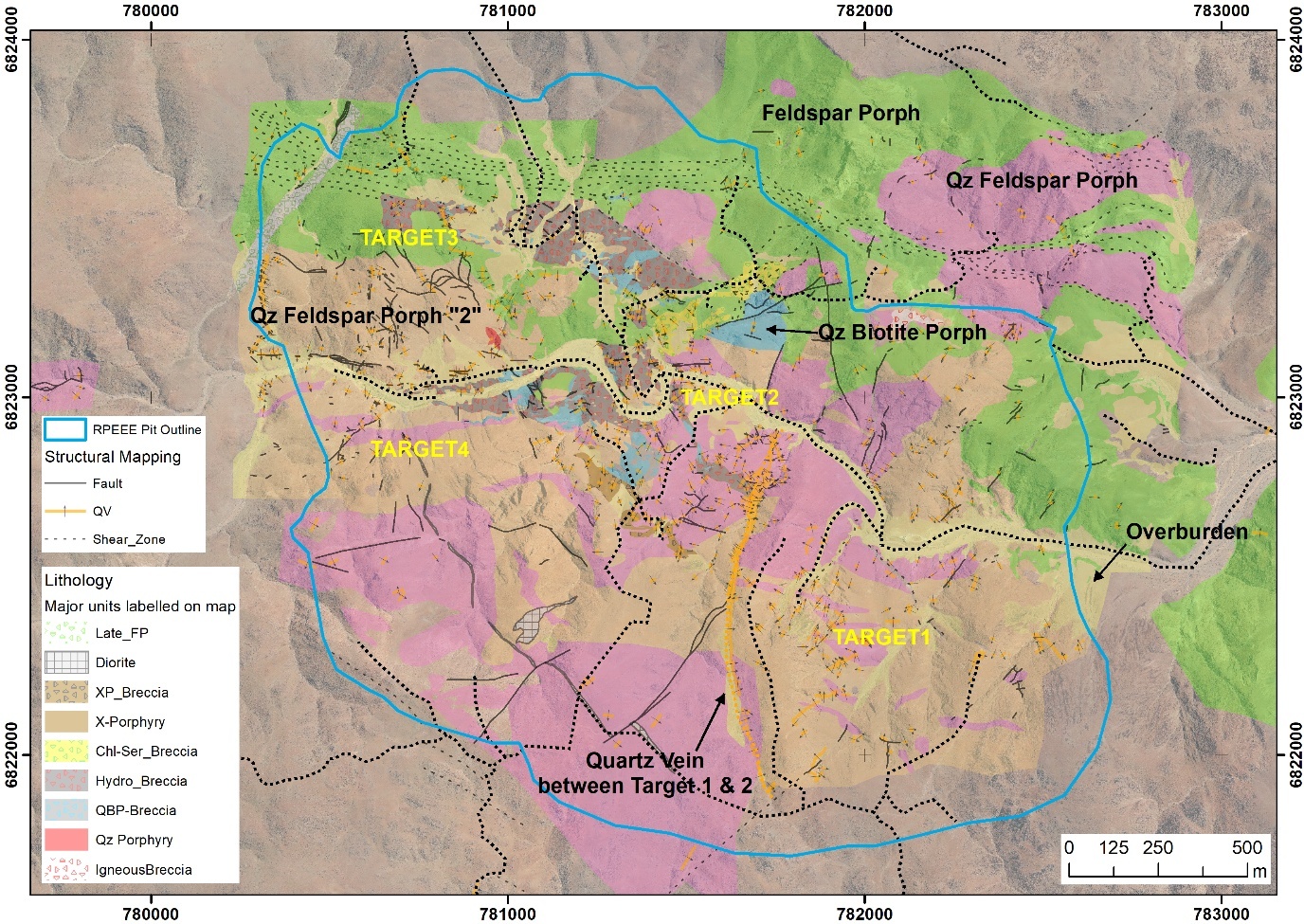

The deposit is divided into four areas which show differences in their host lithologies, alteration and styles of mineralisation.

Target 1 is in the southeastern portions of Haib and is bounded by the quartz vein in the west, potential faults in the south and east but is open to the north. Potassic alteration dominates with Cu mineralisation hosted in quartz feldspar porphyries. The high-grade Cu mineralisation trends almost WNW to ESE and dips towards the northeast at 15°-20°. Mo is present but not as well developed as in the other target areas.

Target 1 is interpreted as being from deeper within the original porphyry complex than the other target areas.

Target 2 is located centrally in a broad band of Cu mineralisation trending northwest to southeast, dipping at >80° towards the southwest. It is bounded by the quartz vein in the southeast and the feldspar porphyries that host Target 3 in the northwest. Better Cu mineralisation is associated with hydrothermal breccias but the quartz feldspar porphyries are also well mineralised in places. The upper portions of Target 2 are dominated by propylitic alteration, becoming potassic with depth. Mo is well developed across most of Target 2 but particularly in the central and western parts.

Target 3 shows some of the widest and highest-grade Cu intersections at Haib. Cu mineralisation appears to start on surface and is associated with steeply dipping breccias within the feldspar porphyries present here. Mineralisation terminates against the large east-west striking, steeply dipping shear zone that defines the northern limit of the Target 3 mineralisation and against possible fault structures in the west. Propylitic alteration dominates. Mo grades are low initially but increase with depth where a number of wide, higher grade intersections were obtained.

Target 4 is disconnected from the northwest-southeast trend along which the other Targets lie but appears to extend to and intersect with Target 2 in the east. Propylitic alteration dominates with the highest Cu grades occurring in steeply dipping breccias as well as within quartz feldspar porphyry. Overall, Cu mineralisation exhibits an east-west trend dipping steeply (>80°) towards the south. In the north it terminates against a series of parallel east-west faults. Mo is very well developed and along with the western portions of Target 2 exhibit some of the best Mo intersections obtained to date.

Geology of the Haib porphyry copper deposit (modified from Teck mapping from c. 2012).

Drilling by the Company since late 2023 has focused on in-fill drilling to improve the confidence in the mineral resource and to focus on higher grade zones that became evident once the Company implemented the routine drilling of inclined holes. All drilling is carried out with an oriented core to ensure accurate structural data is collected to assess the control of high grade zone orientations.

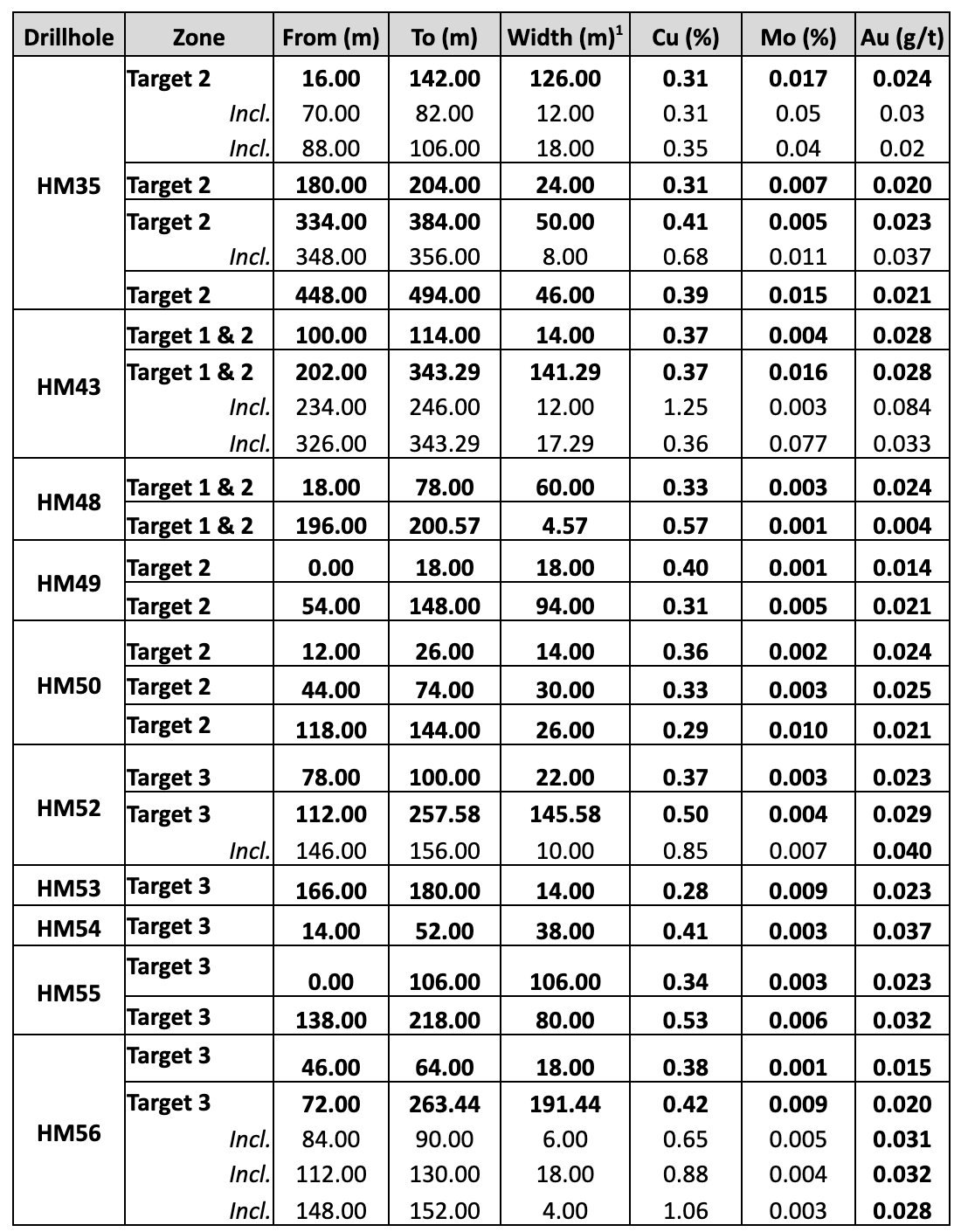

Recent results from Koryx’s Phase 2 drilling include (February 2025):

2024 Updated Mineral Resource Estimate

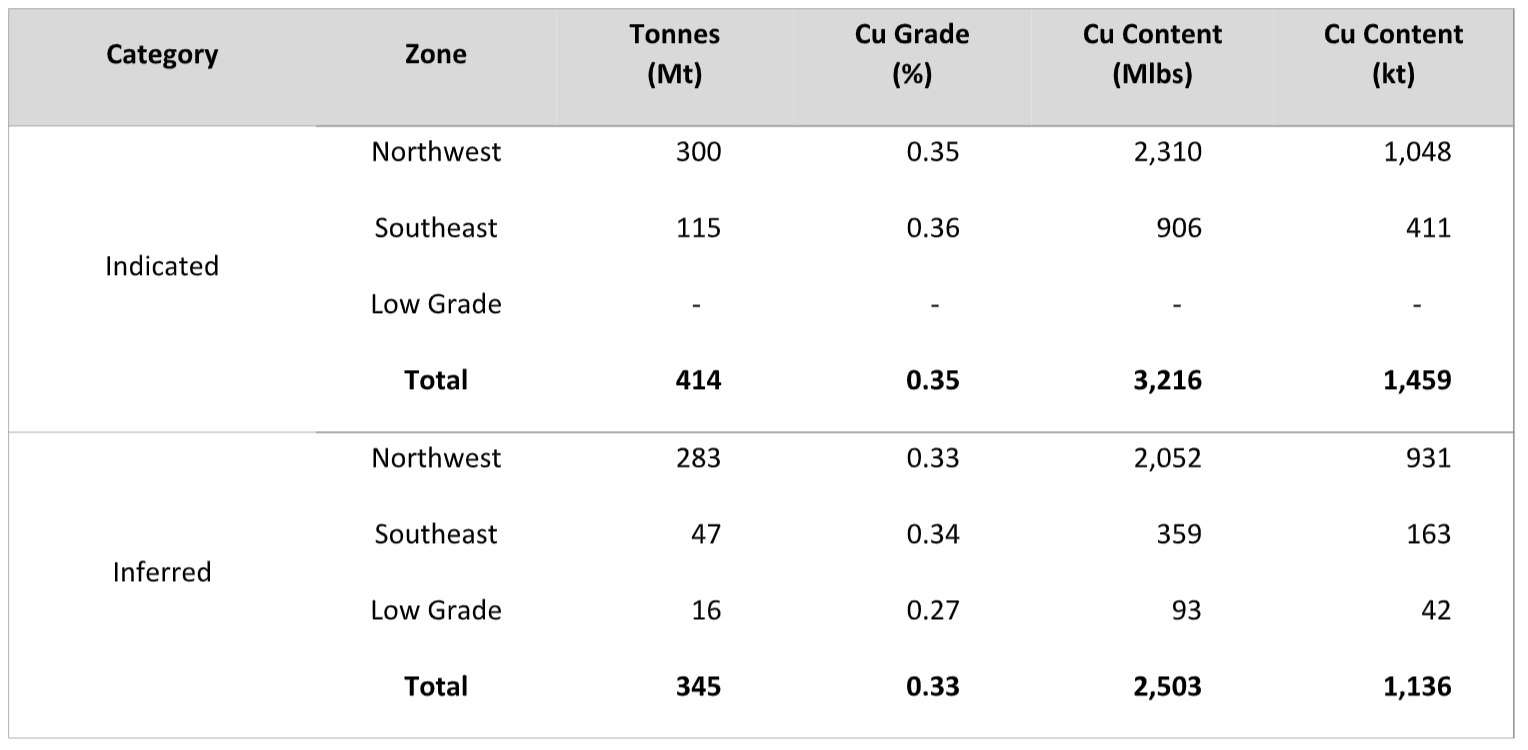

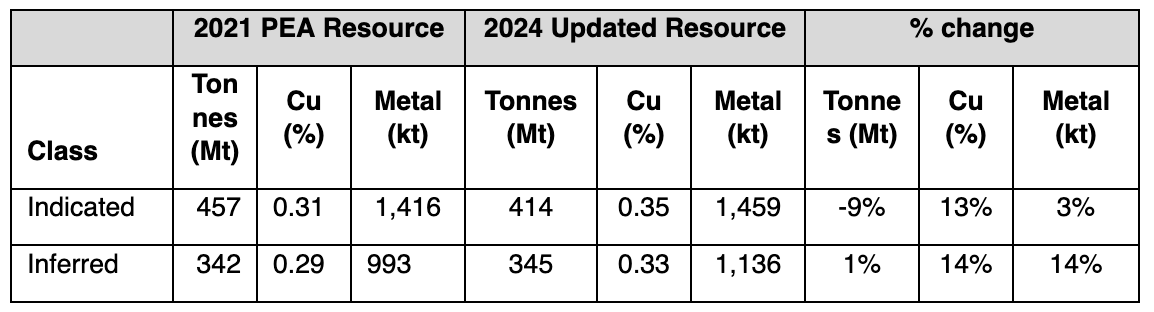

An updated Mineral Resource Estimate was filed with an effective date of 31 August 2024 (the related NI 43-101 technical report can be found on SEDAR+ and here).

The Mineral Resource is classified into Indicated and Inferred categories and is reported at a cut-off grade of 0.25% copper (Cu).

A summary of the Mineral Resource estimate is presented in the table below.

From the assumed parameters a 0.1% Cu in-situ marginal cut-off grade was calculated, which, together with the optimised pit shell demonstrates reasonable prospects for eventual economic extraction (RPEEE) for the Mineral Resource. The assessment to satisfy the criteria of RPEEE is a high-level estimate and is not an attempt to estimate Mineral Reserves.

In comparison with the resource which was declared in the PEA report published in 2021 the updated Mineral Resource Estimate shows a decrease in tonnes by 9% for Indicated material but an increase in grade by 13%. The Inferred material shows both an increase in tonnes by 1% and an increase in grade by 14%, as shown in the table below.

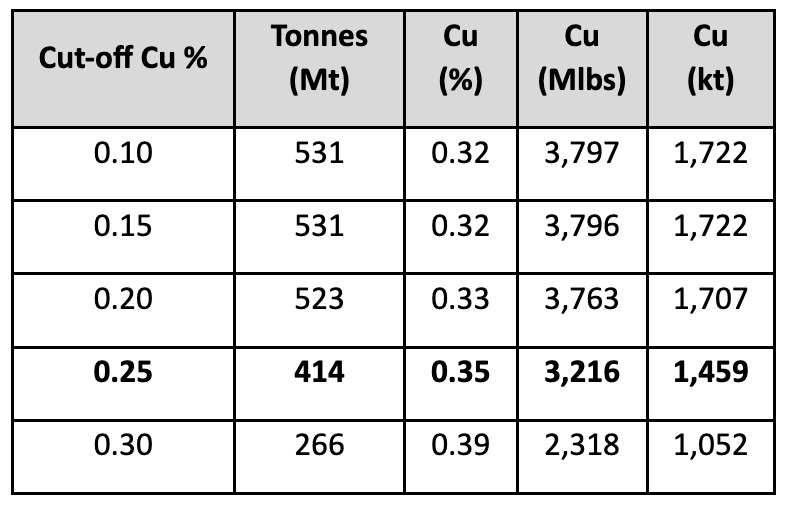

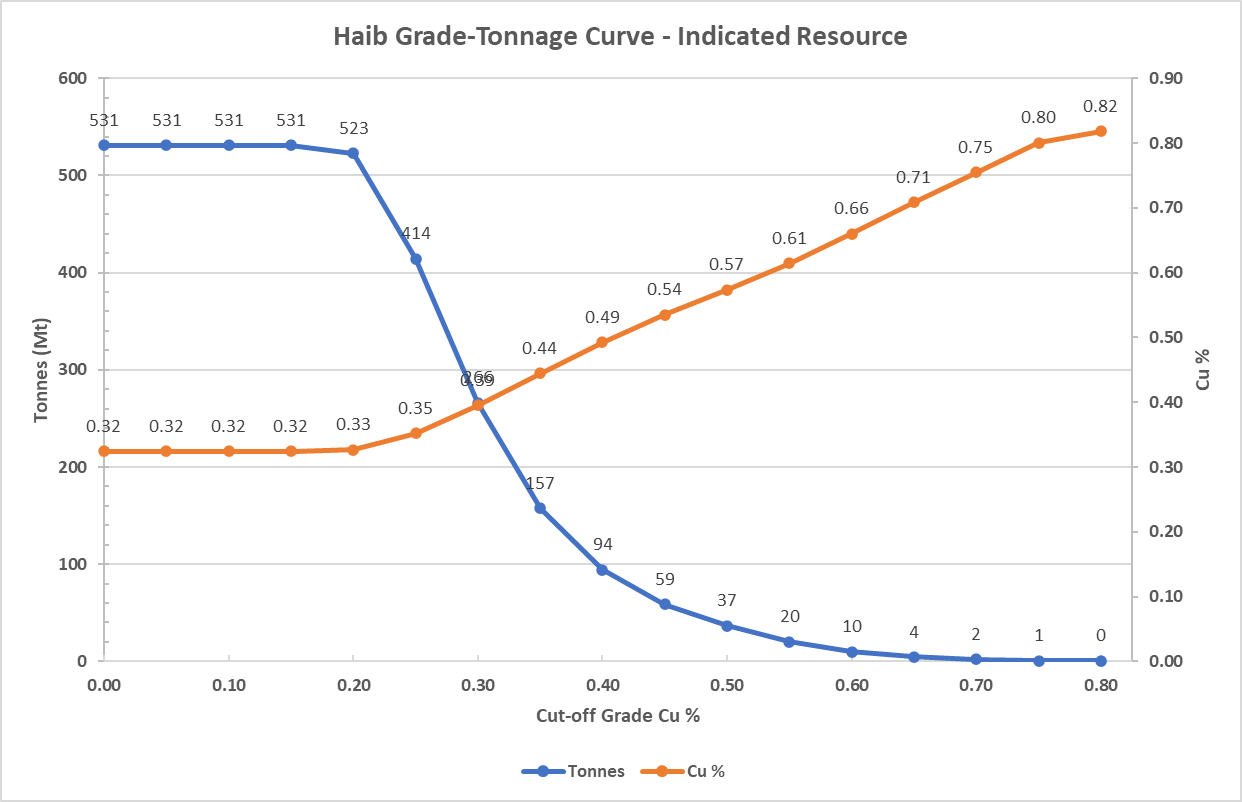

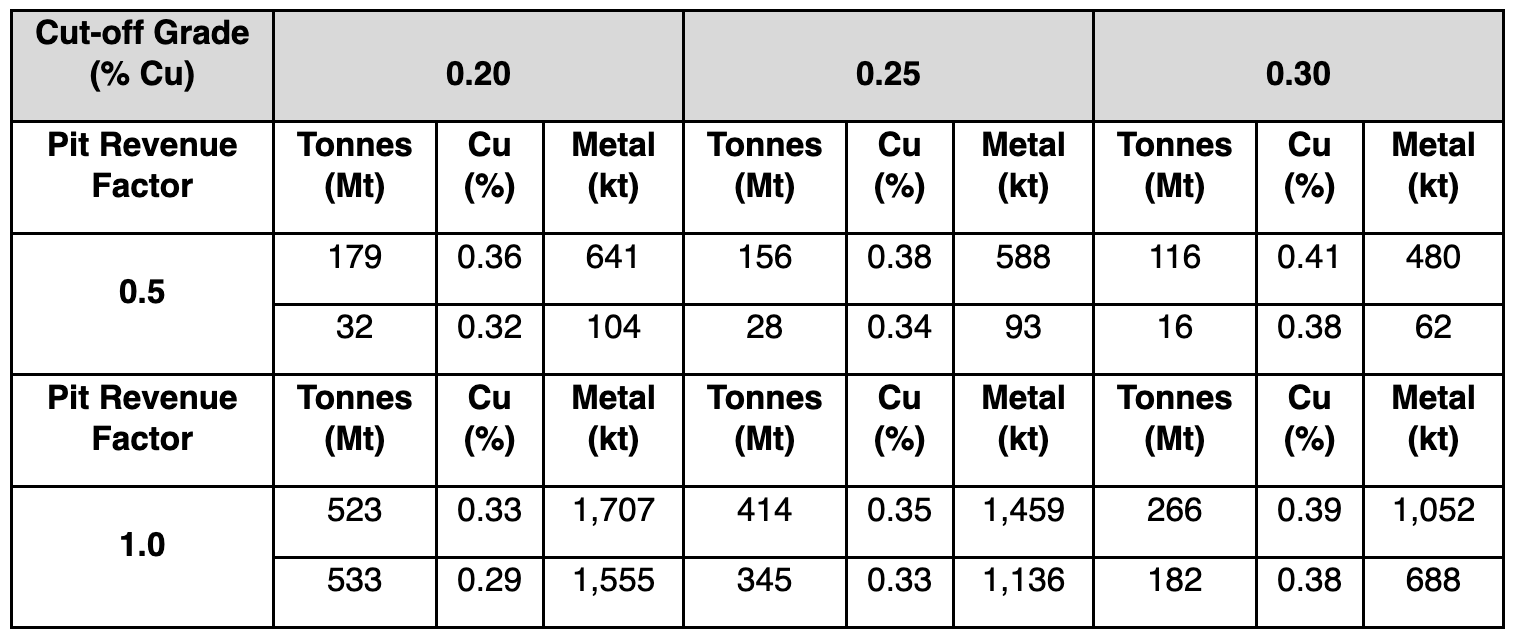

The Indicated Mineral Resource is shown at various cut-off grades in the Table and Figure below.

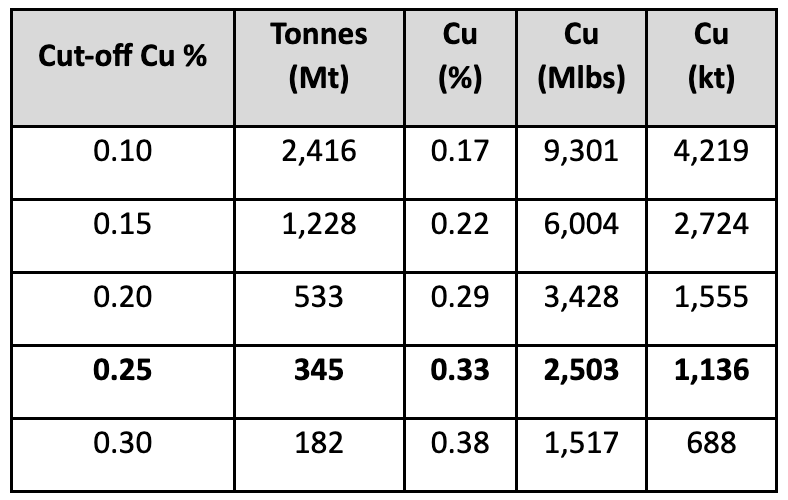

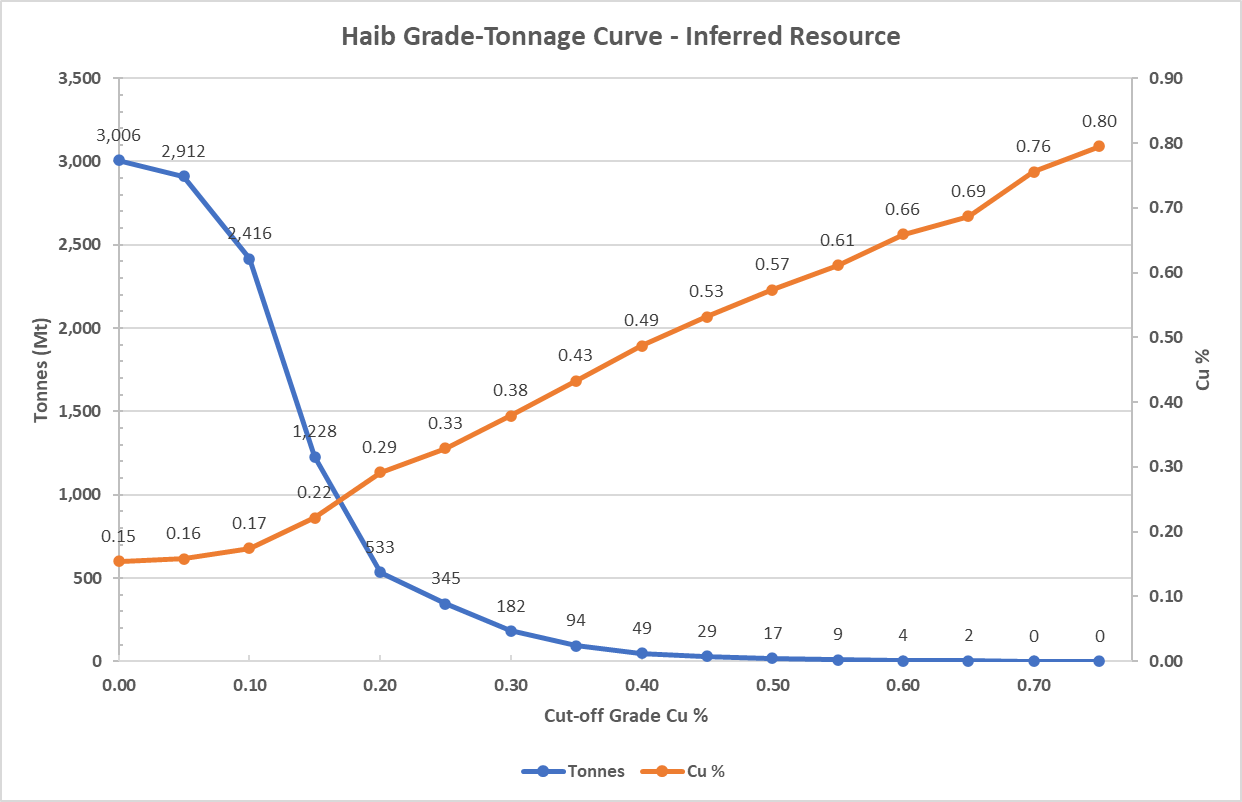

The Inferred Mineral Resource is shown at various cut-off grades in the Table and Figure below.

A sensitivity analysis was performed to determine the robustness of reducing revenue received from lower Cu commodity prices. Using a Revenue Factor of 0.5 to simulate halving the Cu price to USD 2.25 /lb produces an Indicated Resource of 116 Mt @ 0.41% Cu for 1,058 Mlbs. This higher-grade potential starter pit would be attractive for the capital payback period.

The Haib mineral resource estimate included information obtained from diamond drillholes completed between 1963 and 2024 with drilling comprising a total length of 78,934 m. In addition, one underground adit was channel sampled over a length of 126 m. The historical data was extensively validated, and all data collected by Rio Tinto Zinc (120 drillholes from 1972 to 1975),

Great Fitzroy Mines (13 drillholes from 1995 to 1999) and Teck (32 drillholes in 2010) were accepted for use in the Mineral Resource Estimate.

Samples from two drill campaigns (King Resources and Falconbridge) comprising a total of 29 drillholes completed during the period 1963 to1969 were excluded from grade estimation as MSA Global, the companies resource specialist (MSA), was unable to satisfactorily validate this data. Koryx drilled 45 NQ-sized holes from 2021 to 2024, which verified the nature of the mineralization in the historical database and infilled the drilling grid along the main mineralization trend.

Mineralization has been intersected by diamond drilling to a maximum depth of 790 m below the topographic surface. Copper mineralization is predominantly chalcopyrite, however small amounts of supergene copper mineralization in various mineralogical states occurs near surface to shallow depths (generally less than 10 m).

The technical and scientific information relating to the mineral resource estimate and related information described was compiled and approved by Jeremy C. Witley, Pr.Sci.Nat (nr 400181/05), who is a qualified person as defined by National Instrument 43-101—Standards of Disclosure for Mineral Projects (“NI 43-101”) and is independent of the Company and the property which is the subject of the Technical Report. Mr Witley is employed by MSA.

Drill Program Planning for 2025

The Phase 2 drill program commenced in November 2024 comprises 8,200m of which 3,550m was completed by the end of 2024. The complete program is due to be completed during Q1 2025 with assay results to be reported throughout Q1 2025.

Planning for the follow-on Phase 3 drill program (29,000m) has been completed and drilling will commence immediately after the completion of the Phase 2 program late in Q1 2025. This drilling has been planned to further extend the higher grade areas (10,000m) plus infill and mineral resource extension drilling (19,000m).

A further 20,000m of Phase 4 infill drilling (reducing average drill spacing from 150m down to 75m) will be required to convert at least 80% of the mineral resource to the “Indicated” category. This drilling is expected to be completed during Q3 of 2025, thereby allowing for inclusion into the planned PFS to be published at the end of 2025. This will likely also fulfil the minimum confidence level required for the follow-on DFS study to be published at the end of 2026, although a significant quantum of additional infill and expansion drilling will likely be completed before then.

The key objective for the 2025 drill program is to increase the mineral resource grade and we will achieve this by:

The figures below show the planned drilling for Phase 2, 3 and 4. Phase 3 drilling is expected to be completed in half year and Phase 4 drilling by the end of 2025.

Planned drilling for Phase 2, 3 and 4, to be completed by the end of 2025.

Planned drilling for Phase 2, 3 and 4, to be completed by the end of 2025.

Metallurgical Testwork Including Innovative Technologies

Koryx’s metallurgical test work campaign is well advanced and builds on the high-quality work done by others since 1996, based on the exploration activities completed by Rio Tinto and Teck Resources since the 1970’s and 2000’s respectively.

The objective of Koryx’s metallurgical testing is to a) demonstrate the feasibility of a conventional processing route (crushing, grinding, flotation), producing a high quality clean concentrate from the higher grade material at Haib (>0.25% Cu) and b) demonstrate the feasibility of a heap-leach processing route to treat the lower grade material (<0.25% Cu).

There are several innovative and relatively novel technologies with laboratory test, site demonstration plant or small-scale commercial references, that have the potential to be applicable to the Haib mineralised material. Koryx plans to test two alternatives with the assistance of the technology suppliers, test laboratories, andindependent consultants specialising in chalcopyrite leach processes. These technologies are relevant because of their ability to overcome the passivation challenge associated with leaching of the chalcopyrite mineral which is the dominant form of copper mineralisation at Haib.

Composited borehole core samples for a total of about 4 tonnes of material have been selected. These samples exhibit a range of copper, gold and molybdenum grades as well as some variation in mineralogical composition. Work is in progress on minerals processing tests of ore grading >0.25% Cu. This work aims to confirm or enhance the results of laboratory and pilot tests carried out in 1996, with the following tasks to be performed in the laboratory:

In addition, about 2 tonnes of low grade samples (with grades of 0.15% to 0.35% Cu) are being collected in Q1 2025 for hydrometallurgical variability tests. These are expected to include:

Trade-off Studies and Additional Technical Assessments

At this early stage of this type of mining and processing project, there are many possible alternatives in each link of the value chain. The Koryx team and its technical consultants are assessing the techno-economic potential of most alternatives with the aim of de-risking, right sizing and optimizing the project.

The metallurgical test results will be used to support or confirm the expected results of the following process trade-off studies:

Comparison of different pre-concentration flowsheets including rock sorting, DMS and coarse particle flotation.

Assessment of optimal crushing and milling configuration.

2025 Development Study Approach

The PEA will describe a staged project development strategy, which will include as Stage 1 a conventional process flowsheet comprising flotation and concentrate production for the higher-grade ROM material. Stage 2 of the project could include a hydrometallurgical process flowsheet including heap leaching and solvent extraction / electrowinning (SX/EW) for the lower grade ROM material. The Company is confident that a high degree of confidence can be ascribed to the trade-off studies as the input data will be based on actual test results and/or benchmarked data from similar projects.

The PEA will be followed up immediately by a PFS focussed on engineering the unit processes and infrastructure requirements which would generate the optimal economic outcomes for Haib. A key aspect of the 2025 PEA is right-sizing the operation to optimise the life-of-mine (multi decade) whilst maximizing copper production. Koryx is evaluating a processing plant throughput operating range of 20 to 30mtpa crushed material (run-of-mine). Applying industry average copper recovery factors, the project could produce 60 – 100ktpa of copper (combination of copper contained in concentrate and refined copper cathode) over a life of mine of 15 – 25 years.

Regional Targets – Haib Licence Area

Previous work, by Teck in particular, highlighted several regional targets that had limited work carried out on them.Regional targets were identified based on satellite imagery interpretation and mapping (e.g. targets West, East, South, HR-1 and Southwest), hyperspectral colour anomalies (HY-1) and IP data (NW-IP and Hyperspectral target), as shown in the map below.Limited follow up has been carried out on the targets immediately adjacent to Haib, with some drilling at South (4 drillholes), West (4) and East (12). In all cases the work performed was not sufficient to test the targets.

Koryx plans a regional program which will run in parallel to the PEA and PFS work at Haib during 2025, and will focus on mapping, selective sampling, ground geophysics and drilling. Available regional geophysical data is of moderate quality and an airborne survey is also being considered.

Regional target areas around Haib plotted on satellite image with selected geochemistry data plotted.